How should SDR outreach at B2B software vendors be realigned for COVID-19?

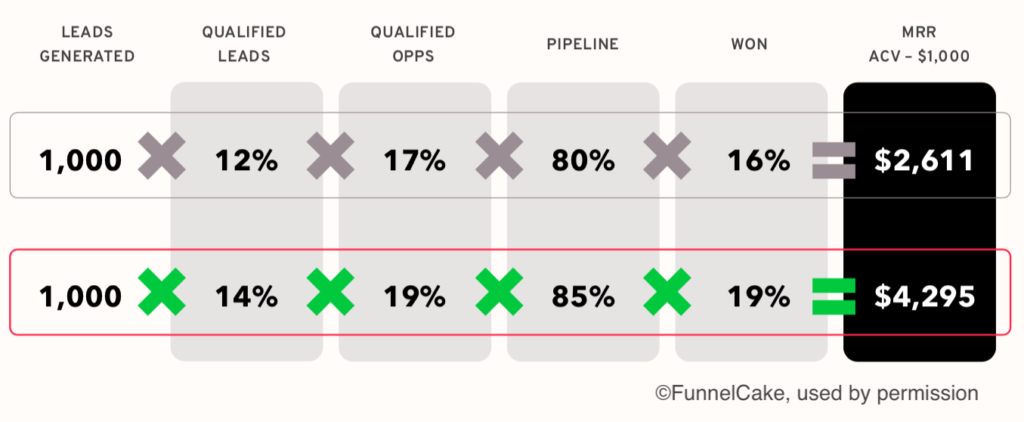

Damage estimates by industry should of course be considered. But don’t forget to consider your offering’s historical performance in those markets. Prospecting in ICP segments with lower win rates may have more downside than upside right now, even if those businesses haven’t been badly hurt by this crisis. I recommend taking a quality over quantity mindset.

Your Wins Are More Important Than Your Losses Right Now

In my work as a win/loss consultant, clients are usually more interested in learning from their losses than their wins. This is partly caused by loss aversion psychology and partly by a fear that eliminating low-converting segments from the ICP will hamper revenue growth.

Yet, at this moment, you should consider prioritizing the ICP segments where your win rate is highest. Continuing to prospect at pre-COVID-19 levels in low-converting segments—when prospects will engage with only the strongest value propositions—will likely damage your brand and reputation, undercutting future revenue. While it’s important to fix the gaps which hurt win rates in these low-converting segments, that’s likely to require a sustained cross-functional effort that won’t impact the next 1-2 quarters of pipeline.

How To Test A Quality Over Quantity Approach To Prospecting

Here’s a four-step approach that can be used by anyone who needs to adapt to the crisis caused by the Coronavirus and wants to test a quality over quantity approach to prospecting.

- Identify high priority ICP segments by combining industry-level damage estimates with your own historical performance data. Run an Opportunity Report in your CRM to generate product-level win rate by industry. For each industry you target, add an estimate of Coronavirus-related damage. (IBISWorld’s industry-level estimates are here.) Prioritize the ICP segments which maximize historical win rate and minimize likely Coronavirus impact.

- Dig deeper to look for any other attributes that can be used to improve messaging and targeting in high priority ICP segments. Look for winning patterns by company size (eg, mid-market or enterprise), use case, legacy solution, and technology infrastructure. It may be necessary to query reps or use desk research to enrich the CRM report, depending on how robustly opportunities are documented in your CRM.

- Interview B2B buyers in the high priority ICP segments to learn how to more efficiently generate leads and stop leaks in the funnel. Starting with the top-ranked segment, schedule phone calls with 5-10 recently won opportunities, ideally from Q1. Most importantly, ask how your value prop has been affected by Coronavirus. How would these buyers justify your solution if they were buying now. Have the buying team or buying process changed. How would the other roles on the buying team view this purchase now. With the remaining time, learn how to improve your targeting and communicate in this segment’s lingo by discussing the buying context. Was the trigger a problem with the status quo solution or an opportunity to do better. Learn how to improve lead to opportunity conversion by asking which analysts, review sites, blogs, and peer groups influenced their initial perceptions of solution categories and vendors. With an open mind and good questions, you’ll learn a lot.

- Build, measure, learn. Use the learnings from steps 1-3 to write some new emails for the high priority ICP segments, and split test them against the current emails and lists. Based on results, reallocate outreach to the high priority ICP segments and the new emails. Use a buyer workshop to enable the SDR team with “behind the curtain” insights you obtained from the interviews. Fluency in the buyer’s journey, perceptions, and experience will improve SDR confidence and agility during ad hoc phone calls and emails.

This Is An Opportunity To Do Better

Prospecting must change. Your buyers and sellers are struggling with the disruption brought on by Coronavirus; response rates have fallen; most of us are WFH and not quite as productive; budgets and resources are being cut. These are all good reasons to test a lower volume prospecting strategy that prioritizes efficiency and effectiveness.

By doubling down on their wins, vendors are able to continue building pipeline—while avoiding damage to their brands and reputation.

Related Posts

Sales Win Loss Analysis: Why Data-Driven Leaders Are Leveling Up

Sales win loss analysis helps leaders make data-driven decisions. What’s working and where can we double-down? What isn’t working, and how do we fix it?

Win/Loss Analysis Reports: 3 Things You’ll Learn

Which aspects of your product offering and buying experience are helping drive sales? And which aspects are hindering sales? This is what enterprise and mid-market software companies often struggle to understand. A good win/loss analysis report will provide the answers to these questions.

Three Reasons Sales Leaders Want Even More Data About Their Buyers

While B2B sales teams are literally swimming in data, it’s not enough. Data-driven sales leaders are using input directly from buyers to find new ways to improve win rate and lead with conviction.