What Is A Win/Loss Analysis

Win/Loss Analysis is a bottom-up, inductive methodology for identifying and understanding the issues that cause deals to be won or lost.

Data about individual sales opportunities is sourced either from sellers or directly from buyers. An analyst then uses purpose-built software to form theories about the key causes of win/loss outcomes.

Win/Loss Analysis provides a novel and objective assessment of the issues and opportunities in a business’s go-to-market strategy.

Why B2B Technology Leaders Implement Win/Loss Analysis

Businesses in technology markets underperform when their leaders rely more on experience and market knowledge than they do on data.

This is because B2B technology markets are complex and change rapidly. Technology companies continuously iterate their offerings and go-to-market. New vendors enter the market and others exit. Buyer needs and expectations change along with the changing conditions. It’s unlikely that what’s worked before will work again in such a complex, quickly changing environment. Mistakes and re-dos are more likely.

Gartner has researched the impact of rigorous Win/Loss Analysis, and even quantified it. Todd Berkowitz at Gartner summarized the benefit this way:

Those that take a more comprehensive approach have seen a 15% to 30% increase in revenue and up to 50% improvement in win rates.

Win/Loss Analysis is well suited to these rapidly changing conditions because it takes a bottom-up, empirical approach. Data about individual sales opportunities is analyzed to identify the key factors in recent buyer decisions.

This approach supports more effective decision making and execution.

Reports from a Win/Loss Analysis based on buyer interviews can tell you:

-

- Which factors (individually or jointly as a cohort) are driving win/loss outcomes

- How prevalent each of these individual elements are

- Whether they have a positive or negative influence, and how strong it is

- Why these factors are influencing buyer decisions

Recommended next steps are also often provided.

Check our post “Win/Loss Analysis Reports: 3 Things You’ll Learn” for report samples and more.

Data Sources for Win/Loss Analysis

The robustness of a Win/Loss Analysis depends heavily on the data source.

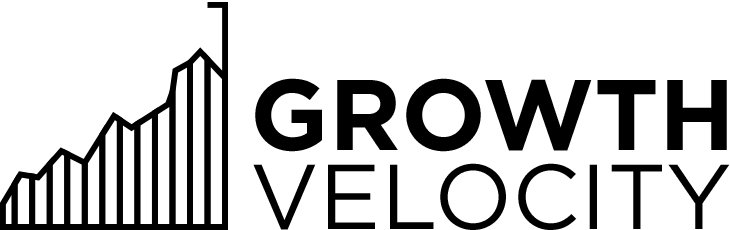

Most B2B technology companies analyze some data about their sales wins and losses. These are the three most common data sources:

-

- CRM reason codes. CRM implementations almost always require Closed/Lost reason codes, and some also require sellers to record Closed/Won reasons.

- Loss reviews. Sales teams use loss reviews to analyze and learn from critical losses.

- Buyer interviews. Product marketing teams interview new customer wins and may attempt to interview buyers in lost deals, too.

Use case drives the decision about data source.

Competitive win rate can be quickly calculated using deal-level competitor data in the CRM. And apps are available for Salesforce to make this basic win/loss reporting even easier. See our review of all the options for Win/Loss Analysis in Salesforce.

The key factors driving win/loss outcomes can be identified using quantitative data. For example, CRM reason codes or survey responses.

But to close a competitive gap, or to exploit one, qualitative data from buyer or seller interviews is needed. Qualitative data closes the loop on buyer assessments of marketing and sales interactions, and a vendor’s product offering. This feedback explains why those win/loss patterns exist.

Check our “Guide To Choosing The Best Win/Loss Data Sources” for more pros and cons.

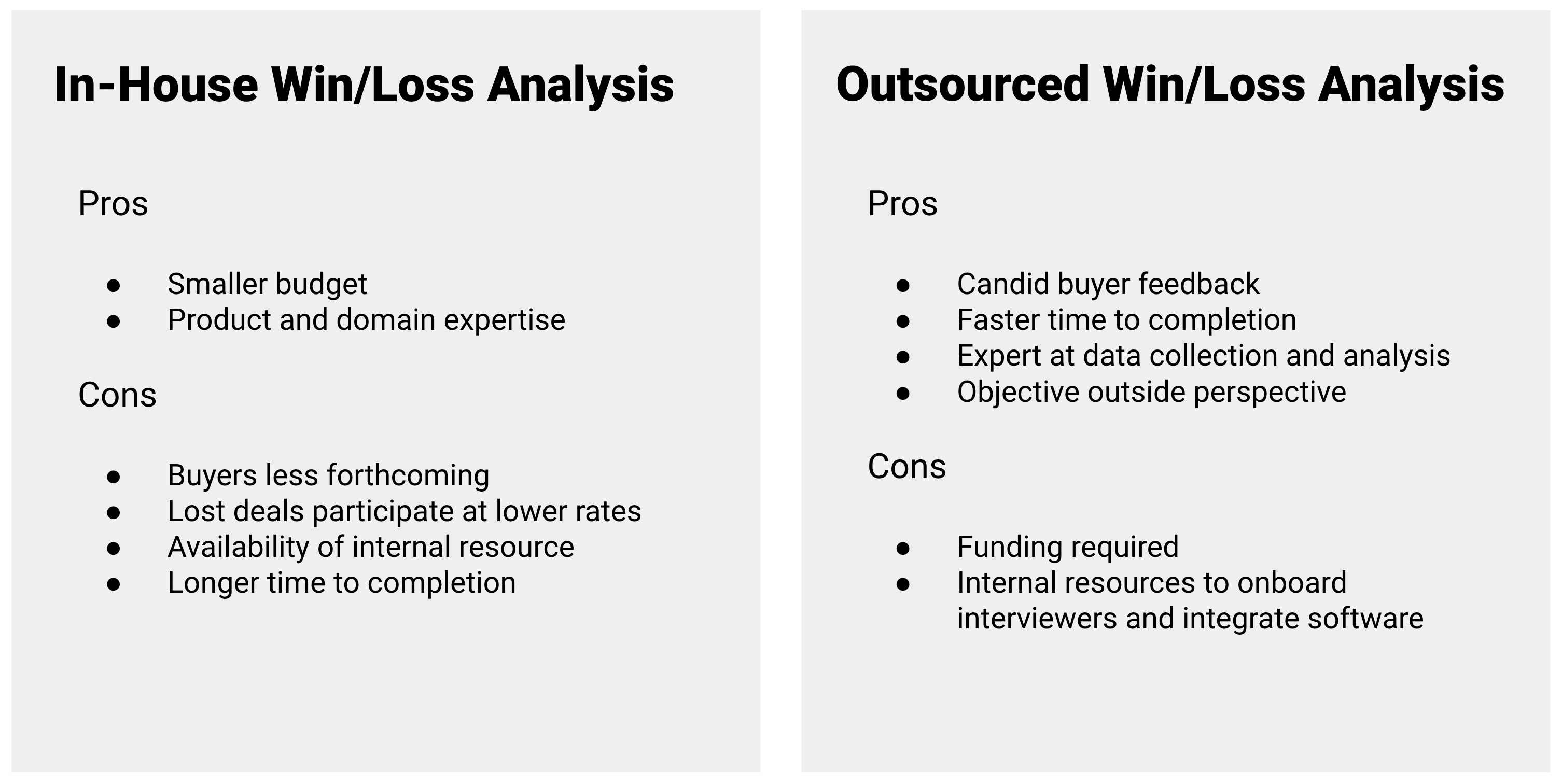

How In-House Win/Loss Programs Start

In-house win/loss programs often begin by analyzing CRM data. Most technology businesses already record Closed/Lost reason codes and competitor data in their CRM. This is an immediately available data source.

But two fundamental flaws of CRM data are quickly exposed as the win/loss program grows.

Data in the CRM is often incomplete or incorrect. This is known as bad CRM data. When we’ve cross-checked competitor data collected through win/loss buyer interviews against CRM data, we’ve found up to 75% of opportunity records in the CRM were wrong.

The second issue is a mismatch between the answers a win/loss team wants and the answers that quantitative data in the CRM can provide.

At Growth Velocity, we talk with sales and marketing leaders that want to “sell higher” and increase pipeline velocity. They want better competitive intelligence. They need closed loop feedback on their pricing model and buyer enablement. And they’re concerned about “reactive decision making” in their product planning process. These are pain points that require qualitative, not just quantitative, data.

These leaders find there’s “nothing substantial to act on” in their CRM. They “have lots of theories but want to know what’s really going on.” They don’t have the “richness of information” they need.

Product Marketing, Product Management, or Customer Success is often called on to conduct buyer interviews in-house. This temporarily bridges the gap.

How Win/Loss Programs Scale To Maturity

As an organization levels up on Win/Loss Analysis, Product Marketing typically takes ownership of the program.

Program scope usually expands at this point because of use case growth, changing market conditions, and goals for continuous improvement.

-

- Use case growth. As a program’s initial findings circulate within the company, more teams seek answers to their questions from it. Competitive intelligence, pricing, product management, demand generation, sales development. Interview volume grows as the use cases increase. This growth isn’t linear, but there’s only so much that can be covered in one 30 minute interview.

- Changing market conditions drive an increase in the volume of interviews, analysis, and reporting. That’s because the accuracy of findings from an initial Win/Loss Analysis deteriorate as the market changes. Products and go-to-market strategies are iterated, and buyer expectations change.

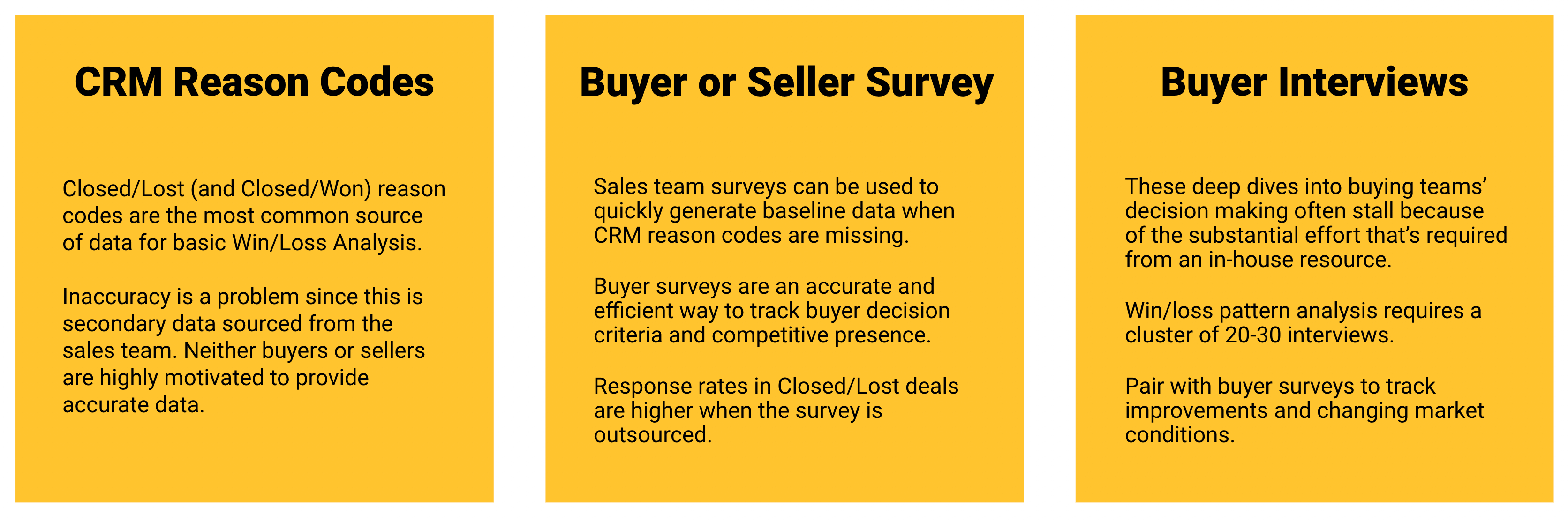

- Continuous improvement. As agile and lean techniques have proven, small, continuous improvements can have a large compound impact. The graphic below illustrates how Win/Loss Analysis provides the learning in step one of this iterative process.

For these reasons, leveling up means the organization’s commitment to Win/Loss Analysis changes from one-time to continuous. Win/Loss Analysis isn’t one and done.

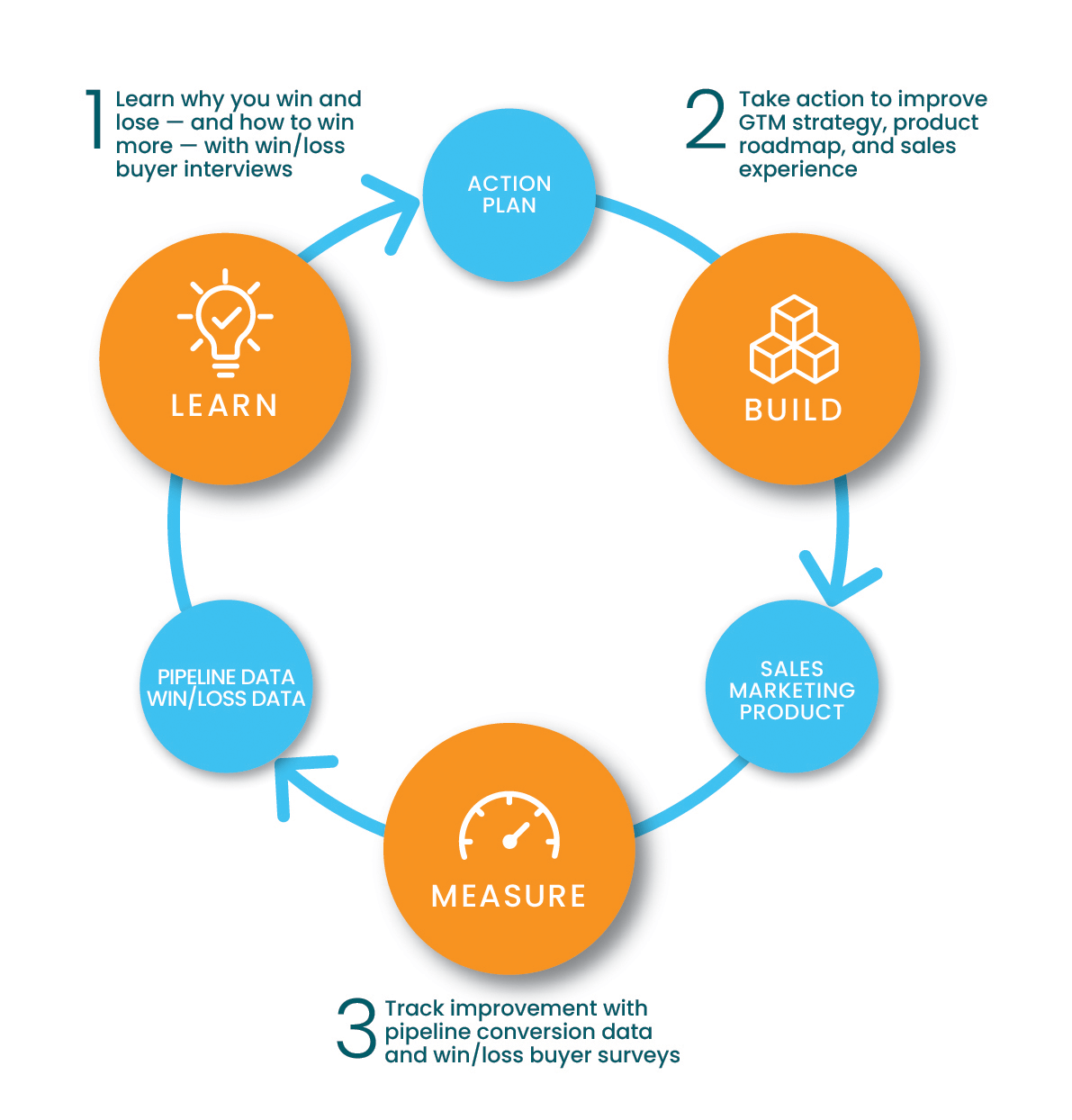

It’s around this time that many organizations assess outsourcing the win/loss program. Interview quality, resource availability, budget, delivery time, and program scope are key factors in this decision.

How Outsourcing Helps Companies Up-Level Their Win/Loss Analysis

Interview quality is higher when done by a Win/Loss Analysis service. Buyers are often more forthcoming with a 3d party researcher. And professional interviewers are more skillful at digging into the issues.

But it’s growing pains that trigger most outsourcing decisions. Use case growth, changing market conditions, and continuous improvement goals make it likely that the volume of interviewing, analysis, and reporting will grow as the program levels up.

Gartner estimates that an internally run program can take “the majority of a devoted resource for at least a quarter’s worth of time.”

A consultant’s win/loss program should be more resource efficient, cost efficient, and deliver findings faster.

-

- Resource efficiency. A win/loss service will use technology to automate the process, reducing demands on internal teams that are often stretched thin. This is especially valuable for the time consuming work of selecting buyers for the interviews and then recruiting them.

- Cost efficiency. A win/loss consultant who has experience with mixed methods research will know how to run a higher volume program at lower marginal cost. In a mixed methods design, buyers are initially debriefed with a buyer survey. The consultant then follows up with a higher cost interview when the buyer’s responses include a high priority issue or competitor.

- Time to value should also be quicker with an outsourced program. In-house programs struggle with low participation rates, especially by buyers in Closed/Lost opportunities. For a mid-market or enterprise sale, an outsourced program should get participation from 70% of buyers in won deals. Eighty percent can be done. Conversion on lost deals should be at least 50% and can be over 60%.

The interviewer at a win/loss service won’t be expert in your product. But that can be managed. Choose an interviewer who has experience with your buyer, and whose onboarding process includes ample time to learn your product. Personal service from long-term employees can make boutique firms the best bet for companies with a complex sale.

Check our guide to selecting a Win/Loss Analysis consultant for more tips.

Upleveled Win/Loss Analysis Is A Competitive Advantage

B2B technology markets are complex and change rapidly. In this challenging environment, modern leaders want data to inform their decisions. Fewer and fewer are relying on experience and market knowledge alone.

Gartner reports seeing this shift in its most recent Gartner Engine for Analytics & Research (GEAR) survey. Inquiries from B2B technology companies about Win/Loss Analysis increased by 5X.

Programs for Win/Loss Analysis often begin with an in-house analysis of CRM data.

But they quickly transition to a more rigorous approach as Product Marketing takes ownership of the program. Data is gathered directly from buyers with interviews and surveys. Cross-functional interest and use cases grow. Cadence changes from one-time to continuous.

Todd Berkowitz at Gartner summarized the benefits of a rigorous, thoughtful approach to Win/Loss Analysis in this way:

While the vast majority of Gartner clients (and likely non-Gartner clients) do some form of win/loss analysis, only a minority (likely 35-40%) conduct it in a comprehensive, rigorous and thoughtful manner…

Those that take a more comprehensive approach have seen a 15% to 30% increase in revenue and up to 50% improvement in win rates.

And for the leaders in sales and marketing that sponsor and lead the work, there’s the benefit of pride and making an impact. The findings and recommendations from a well-executed win/loss program are a go-to resource everyone wants to see.

Related Resources

Selecting A Win/Loss Analysis Consultant? Here Are 5 Tips

Selecting a Win/Loss Analysis consultant is an important decision. Here are 5 tips that will help you make a good choice.

How To Conduct A Win/Loss Analysis

The seven steps described here have been proven through years of in-the-trenches experience.

Guide To Choosing The Best Data Sources For Your Win/Loss Analysis

Pros and cons of four common data sources for Win/Loss Analysis: CRM Reason Codes, Sales Team Surveys, Buyer Surveys, and Buyer Interviews.